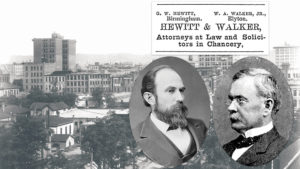

Bradley Arant Boult Cummings LLP is a very large foundation stone in Alabama’s business history. The Birmingham-based firm is celebrating 150 years in practice this year. It traces its history to the founding, in 1870, of Hewitt & Walker, which evolved with the city’s industrial roots to become, following World War II, Bradley Arant Rose & White — a firm representing major construction companies and financial institutions.

Following a merger in 2009 with legacy Nashville law firm Boult Cummings Conners

& Berry, the group became Bradley Arant Boult Cummings, a regional firm centered in business law — particularly health care, construction, insurance, pharmaceuticals and

complex regulatory issues. The firm’s 550 attorneys work in 10 offices from Tampa to

Dallas to Washington D.C.

The firm’s chairman and managing partner, Jon Skeeters, describes these more recent years as an active balance between strategic growth and a legacy culture.

“You can reach a tipping point where you could become just a bunch of people at different offices,” says Skeeters. “We’ll fight hard to avoid that. You have to reach a balance that allows you to stay competitive, invest in the right resources in technology and talent to get the complex work that all lawyers like to do. We’re getting that now. So, we’re not looking for other markets. We’re opportunistic, but we want to be smart about our growth.”

That sense of balance was in evidence at the firm’s 150th anniversary celebration in Orlando in early March, says Skeeters. “That retreat reinforced that for us. We have a lot of people, have expanded to 10 offices and have 550 attorneys, but it still feels close knit, still represents the culture that we want.”

Maintaining that balance also gives the firm an edge in competitive pricing, adds Birmingham Managing Partner Dawn Sharff, in a time when corporations are working hard to control legal spending, often by building in-house legal departments.

“Financial services, construction, health care, all require a high-caliber lawyer team to do their work,” says Sharff. “Our clients realized, as they grew and as our peer firms were trying to get work from them, because we’re headquartered in Alabama — we don’t have an office in Manhattan or San Francisco or Boston — we were able to give them the kind of work they need at a price that is right.”

As health care grew to be as prominent in Birmingham as heavy industry, the firm grew in that specialization as well, representing HealthSouth — now Encompass Health — and Surgical Care Affiliates, one of the largest outpatient surgery providers in the country.

“Hospital systems nationwide have grown out of Nashville, a hub of healthcare, which is one of our calling cards firm-wide, from an industry and brand recognition standpoint,” Skeeters says.

Practices related to regulated industries in general also have seen a rapid growth in recent years, including banking, health care and pharmaceuticals.

“Financial services and health care are very regulated, a lot of things to navigate, two big areas that produce increasingly more government enforcement and white-collar issues,” says Skeeters. “In pharmaceuticals, our work is on the litigation side, defending multi-district, class action lawsuits at the regional and national levels.”

Areas of specialization have grown organically, he says. “We want to invest in the things we are good at and know about. We look for lawyers we have a connection with, for a fit in quality and cultural issues. One of our key tenets, as we expanded out of Alabama, in every market, every lateral attorney we hire is scrutinized along those lines.”

Geographic spread is dictated by client growth. As construction gravitated to Houston and Dallas, the Bradley firm paired with a similar firm there to cement a role in that market.

Big Birmingham-based banks went through a similar period of consolidation, and the client base evolved with it, eventually regrouping in a way that benefited the Birmingham-based law firm.

“Banking consolidation certainly impacted Birmingham a lot, and it probably took us a little while to be able to rebound and expand into new relationships, with the smaller banks that started to form, particularly in Birmingham and Nashville, when there was a resurgence in community bank startups. We have participated in the strategy and planning, seeing them get started, from the initial setup to regulatory advice and on to the lending side and

deployment of assets,” says Skeeters.

In recent years, the firm also has participated in the growth of private equity finance, which Skeeters describes as “a very hot area.”

“In the last five to 10 years, because of the regulatory environment, a lot of the public companies we represented have gone private. That’s where we have been taking on private equity money in recent years — private equity companies with an industry focus. We help those companies bird dog deals and kick the tires.”

At this benchmark in the company’s history, asked to sum up the firm’s spotlight practices, “Our calling cards,” says Skeeters, “are financial services, licensing, regulatory work and transactional work.”

Chris McFadyen is editorial director of Business Alabama.